In this article, we aim to understand the factors that drive the proliferation of cybersecurity firms in different countries and regions. While most cybersecurity vendors operate globally, we chose to look at the companies’ declared headquarters. We considered this to be an indicator of the desired target markets for cybersecurity vendors.

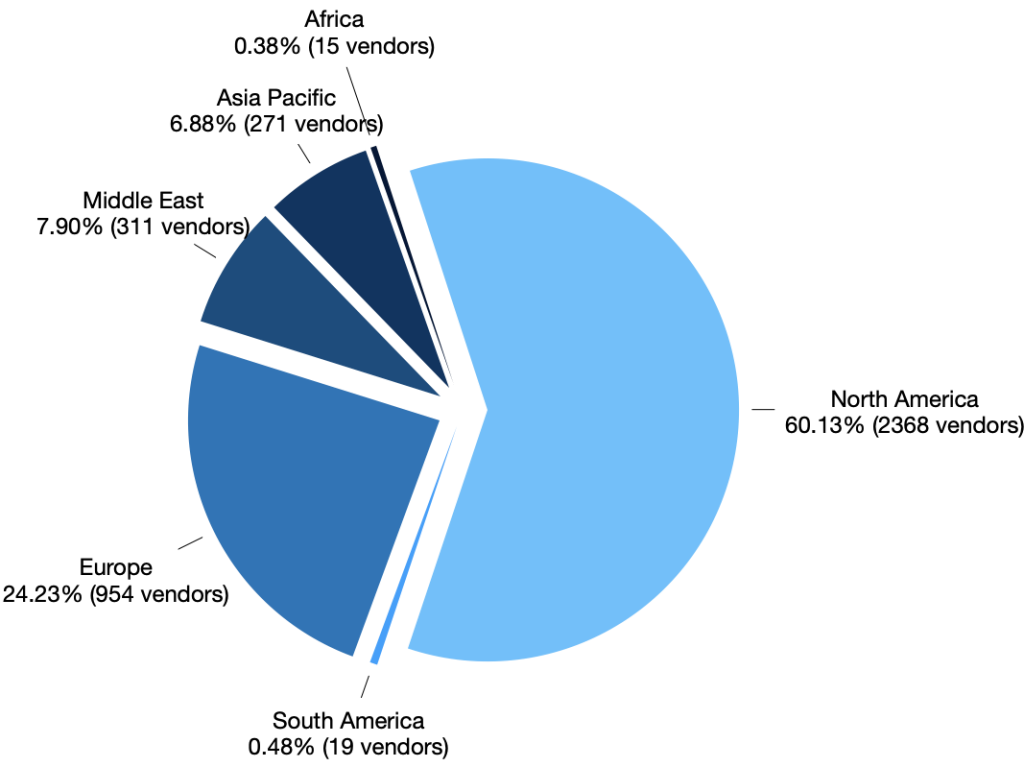

We currently index and analyze 3938 cybersecurity vendors, in 63 countries, with the number growing constantly.

This article explores the geographical distribution of cybersecurity vendors across various regions and analyzes the density of companies relative to the population and the economic capacity.

Geographical Distribution of Cybersecurity Companies by Region

North America dominates the cybersecurity landscape, followed by Europe and the Middle East. The Asia Pacific region also has a significant number of companies, but South America and Africa lag considerably.

The North American region is largely dominated by the United States with 2227 vendors, followed by Canada with 133. United States alone hosts more than 56% of all cybersecurity vendors.

Three European countries dominate the region, United Kingdom (329), France (120) and Germany (116). 32 European countries have at least one cybersecurity vendor.

Unsurprisingly, the Middle East region is dominated by Israel with 295 vendors, more than 90% of cybersecurity vendors in the region. A number of studies, as well as the Wikipedia page dedicated to the Israeli cybersecurity industry, state that there are 450 to 500 cybersecurity companies in Israel, as of 2024. We have noticed a trend and we were able to confirm with data, that a consistent number of cybersecurity startups originating from Israel, move their headquarters to the United States as they mature, seek more funding and more client opportunities. Most of them continue to maintain a strong presence in Israel to tap into the talent pool and cybersecurity network.

The Asia Pacific region’s main players are India (67), Australia (51), Singapore (42), China (31) and South Korea (24).

The regions that are lagging behind are South America, with only 4 countries represented, and Africa with only 3. The most representative countries for these regions are Brazil (13) and South Africa (10).

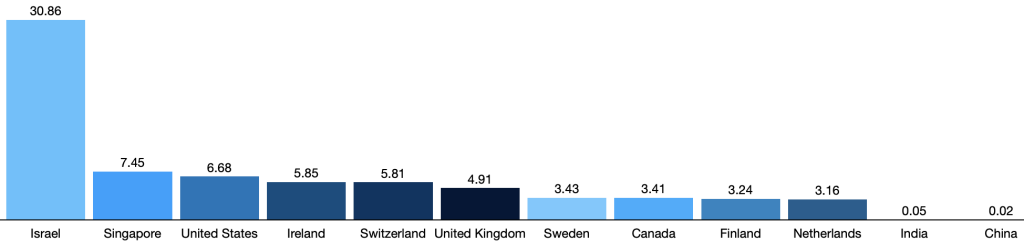

Companies Per Capita: Analysis of Cybersecurity Companies Relative to Population

By looking at the number of cybersecurity companies relative to the population of each country, we aim to analyze the industry density. Below is a table showing the number of companies per million people in selected countries:

Despite the noted trend of Israeli companies relocating their headquarters abroad, Israel is still almost an order of magnitude denser than the following countries with more than 30 cybersecurity vendors for every 1 million inhabitants.

Notable mentions go to Iceland, Luxembourg, Estonia and Cyprus which also show a high density of cybersecurity vendors, but were left out of the chart due to the small sample size and population.

At the other end of the spectrum we find the most populated countries in the world, India and China, with only 0.05 and 0.02 cybersecurity vendors for every 1 million inhabitants.

We can interpret this chart in multiple ways. It’s clear that where the density is high, we find the premises for cybersecurity development: talent, and capital availability and infrastructure. But we can also speculate that there are opportunities in less cybersecurity developed countries with a large potential talent pool, like India.

Conclusion

The analysis of the global cybersecurity landscape shows that North America is the dominant region in terms of the number of cybersecurity companies, but there are significant differences when we examine companies relative to population.

Factors such as government support, digital infrastructure, access to capital, and talent pool play a key role in shaping the cybersecurity industry in each region. As the global demand for cybersecurity solutions continues to rise, regions with proactive strategies in these areas will likely see the most growth in their cybersecurity sectors.

If you are a Buyer or a Vendor of cybersecurity solutions, get in contact with us to find out how Procurities can help you

We’ll get back to you promptly to schedule a video call

Cybersecurity Vendors Around the World: A Regional Distribution Analysis © 2024 by Procurities.com is licensed under CC BY 4.0